Introduction

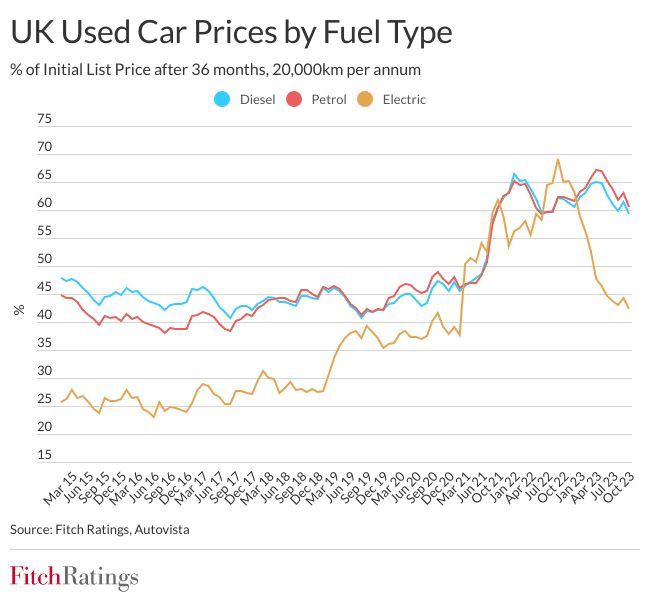

After a period of runaway prices, the motor industry came back down to earth in 2023 as used EV prices experienced large declines. The pandemic-induced supply chain disruptions started to unwind, competition intensified with Tesla leading the charge on price cuts, and the willingness of used car buyers to transition to electric vehicles faced headwinds. The best-selling electric vehicles fell almost a third in the US and by a fifth in the UK.

This article delves into the factors driving the decline in residual values, the broader implications for various stakeholders, and strategic measures to mitigate these impacts.

Understanding the Issue: The Decline in Used EV Prices

The depreciation of used EVs is amplified by uncertainties surrounding battery life and the fast pace of technical change in the sector, where new models are offering superior technology to 3-year-old models, the typical used vehicle. Rising insurance costs and the odd horror story about a private buyer being hit with the cost of a battery replacement have dampened enthusiasm for EVs in the second-hand market.

In a survey of more than 2,000 UK drivers and contributions from 35 dealerships, motor finance lenders, and lease companies including Black Horse, Octopus EV, Vertu, EVA England and Evolution Funding found that 61% of drivers indicated they would purchase an EV. Still, more than a quarter would not buy a used EV unless concerns around batteries, cost and charging infrastructure were addressed.

The Broader Impact of falling prices

Dealerships grapple with inventory management and profitability issues as falling residual values increase the risk of holding depreciating assets.

Car dealerships have been burnt by OEMs discounting, where they were left holding stock that could in some cases suddenly be worth 30% less than they paid for. Given the dealer also has costs to hold it on its premises the longer it takes to sell the vehicle deepens the loss, prompting even further discounting.

Motorpoint, the UK’s largest independent vehicle retailer, issued a profit warning in the past week. The impact of high inflation, interest rates, and consumer uncertainty impacted the demand for used cars according to its Chief Executive, Mark Carpenter.

For Leasing Companies

Unpredictable residual values pose a risk for leasing companies, impacting lease rate calculations and the attractiveness of leasing options.

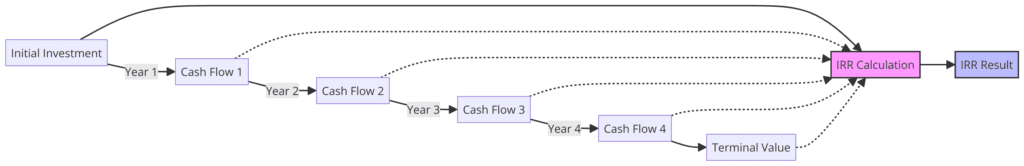

Leasing companies make money by leveraging tax shields and selling the vehicle when these are highest at a premium to the depreciated value, typically 3 years. If the level of depreciation is higher than anticipated then the return the company makes on the vehicle can fall dramatically.

EV specialist lessor Onto experienced this to its cost when it had to use its cash reserves to fund the losses on vehicles it had purchased with debt. It declared it was insolvent in September last year despite raising £100m in January 2023 saying it

“faced challenging market conditions due to the recent steep fall in the price of used electric vehicles, rising interest rates and the squeeze on disposable income.”

For OEMs

As more and more new vehicles are leased, OEMs are dependent on leasing companies for their success. When used EV prices fall, the cost of financing the difference between the value at the end of the lease and the purchase price also rises, increasing the amount the lessor or the case of a PCP finance plan the consumer needs to finance.

Ratings agency Fitch also highlighted that deep price cuts are increasing the number of voluntary terminations in the UK, where borrowers exercise their right under UK consumer credit legislation to return their vehicle in place of making further payments.

This risks destabilising prices further leaving OEMs no choice but to consider reducing production to reduce excess capacity in the system.

Addressing the Challenges: A Roadmap for the Industry

-

- Battery Analytics that can allow buyers and sellers to quickly determine a good versus a bad EV would help reduce friction in the purchasing process.

-

- Educating buyers on the total cost of ownership versus the purchase price, research has shown that used EV buyers have a limited understanding of the reduced running costs of an EV versus a combustion engine vehicle.

-

- Increase the skills base of mechanics and technicians so batteries and advanced driving systems in EVs can be repaired more easily.

-

- Governments can consider supporting used EV sales via tax breaks such as those available in the US where a used EV can benefit from tax credits of up to $4,000.

-

- The industry should work collaboratively to develop the reuse and recycling of EV batteries to underwrite the salvage value of vehicles that reach the end of life.

Conclusion

Although there has been a lot of instability in the past 12 months, we are still confident about the decarbonisation of the Motor Industry. Such a massive shift is bound to generate bottlenecks. In time these will be overcome particularly if technology is leveraged to accelerate the pace of change.

In a recent webinar, Autotrader CEO, Nathan Coe highlighted that used EVs experienced the fastest inventory turn recently, perhaps indicating that price cuts had enticed buyers and some of the barriers to purchase are being eroded.