For decades, the auto industry has relied on the car dealerships system to sell cars to the public. However, a new normal is taking over, which affects the operations of these middlemen as electric vehicle startups choose to sell directly to their clients. Some of these EV makers can bypass the age-long dealership arrangement by making it possible to order online. Even legacy automakers transitioning to battery-powered mobility are making new demands of dealerships if they would carry their EVs.

If you own a car dealership or otherwise have a stake in one, you might wonder what the switch to electric means for your business. This article looks into the challenges and opportunities that the emergence of EVs presents to car dealerships.

The Tesla effect

Tesla is famous for making electric vehicles a practical everyday option and starting some industry trends. For example, it made popular lithium-ion batteries in EVs. The Texas-based EV maker also started a trend in selling cars; direct sales.

Instead of releasing their electric models to established dealers in the US, Tesla chose to open up its website for customers to make their orders. Buyers can also configure their cars to arrive at the best specs for them. The vehicle can then be picked up at the nearest service center or even at their doorstep with a service known as Tesla Direct.

As the market leader in the EV sector, Tesla has seen its sales model replicated by upcoming EV companies. For instance, Rivian and Lucid also allow their customers to order and customize their cars online. Copying the playbook of the most successful player in a sector is not new. Apple has had the same effect in its sphere, with other phone makers releasing phones with notches on the screen after Apple released the iPhone X in 2017. Similarly, other phone makers started ditching packing chargers and earphones with new phones when Apple began doing so with the iPhone 12 series.

Legacy automakers like GM have also made online ordering possible even for their ICE models, but you would usually still have to pass through a dealer to get your hand on your new car.

Why did Tesla opt for direct sales? For one, Tesla believes it can gain more speed in its production and delivery. It also wants to control the customer experience because operating its own showrooms can prevent conflict of interest due to the salespersons. The company has 438 locations globally as of the end of 2021, where it can also carry out repairs.

Legacy automakers still retain car dealerships onboard, but…

Tesla’s anti dealership stance notwithstanding, car dealerships are still part of the sales experience of electric vehicles. Traditional automobile companies are also making EVs, and they still sell them through dealers.

This slice of the pie is important to dealers because EVs have been steadily increasing sales globally. Electric car sales increased 200 percent year-on-year in the second quarter of 2021. In the US, EVs accounted for 3.6 percent of total vehicle sales in Q2 2021, up from 3.2 percent in the first quarter.

The numbers in the US are set to increase with the proposed restoration of the federal EV incentives for brands like Tesla and GM that have outgrown them, opening the way for even more people to switch from gas-powered vehicles

What does this mean for car dealerships?

However, it will not be business as usual for these dealers. Take the US market as an example, where auto dealership is undergoing significant changes. More traditional automakers are considering direct sales to the customers as they shift to electric vehicles.

About half of the states in the country allow car manufacturers to sell directly to customers. However, 12 states make exceptions for EV makers and clean energy companies based in the country. This means the dealers are getting cut out of portions of the market.

In addition, buyers are increasingly attracted to the transparency and consistency in pricing that direct sales enable, cutting out the haggling and paperwork that could be overwhelming at dealer showrooms, especially for first-time buyers.

Do the economics stack up for dealers?

Financially, EV sales are a mixed bag for dealers. For instance, auto intermediaries can earn from finance reserves or a portion of the interest rate when they secure a car loan. With electric vehicles typically costing between $5,000 and $10,000 more than their ICE counterparts, buyers will need these loans more, helping the dealers earn more money. However, this opportunity might be short-lived because many experts believe EVs and ICE cars will achieve price parity in a few years.

However, dealers take a risk in their profit bottom line when it comes to selling used cars. Although currently lower than gas-powered models, the true worth of used EVs is still a moving target. McKinsey believes EVs will eventually hold their value better than ICEs, but how that will play out remains to be seen.

Services revenue may be impacted negatively

Another aspect of the dealership model that EVs might affect is servicing and part sales. Revenues from these two businesses might dip as the McKinsey study mentioned earlier shows that EVs generate only 60 percent of aftermarket business that ICEs bring in. This reduction is because EVs tend to be more reliable because of their design. They have fewer moving parts that can break down and require servicing or part replacements. One direct example is EVs’ braking system that incorporates more regenerative braking, leading to less brake wear.

Increasing the costs of selling EVs is the demand by some EV makers on dealers that want to carry their models. For example, GM has warned dealers to desist from adding high markups to its upcoming EVs with the threat of redirecting sales from them. Ford has similarly tried to stop its dealers from requesting additional deposits on its F-150 Lightning pickup truck.

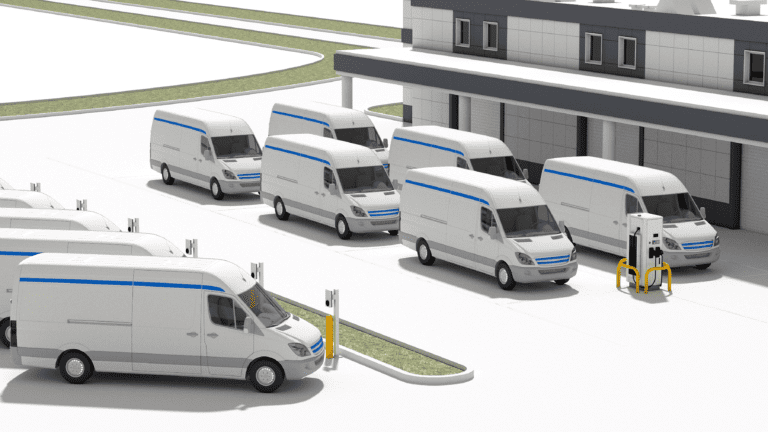

In addition, GM is demanding its dealers invest more in their showroom facilities to qualify to sell its Hummer EVs, including installing EV charging stations and training their staff. Ford wants dealers to make similar commitments if they intend to sell the Mustang Mach-E.

Some dealers have calculated the opportunity costs of these investments (up to $200,000 per store in some cases) and decided to forego selling the EV models.

How car dealerships can prepare for the electrification of the auto industry

Despite the challenges ahead, there are opportunities for EV dealers, making it vital for them to be prepared for the incoming onslaught of battery-powered automobiles. At any rate, the future is electric, with governments globally introducing bans on ICE vehicles. How can dealers position themselves to benefit from the explosion of EVs?

Consider branching into fleets

Electric vehicles are ideal for ridesharing because of their low refuelling maintenance costs. Dealers of used cars can target this demography of buyers to make their inventory much faster. They may also offer fleet services for small and medium-scale businesses.

Retool, retrain, and restock

Selling electric vehicles may require retraining staff and refreshing the facilities. The sales associates must become knowledgeable about electric cars to sell them convincingly. They may gain the knowledge by switching to EVs themselves. Similarly, the workshop staff must be retrained to handle servicing EVs.

Facilities where EVs are displayed and repaired will also need to be upgraded. For instance, dealers may have to install EV chargers and acquire modern diagnostic equipment to handle EVs. Services should be re-strategized to match the reality of electric vehicles.

Dealers should also expand their EV offerings. They can track sales trends to know the models that move best locally. Other incentives include increasing the test drive period or more flexible payment options.

In conclusion, EVs have heralded a new way of doing automobile businesses, and dealers are not immune to the changes. However, with proper strategies, dealers do not have to go out of business.