Electric Vehicles (EVs) are revolutionizing the automotive industry and reshaping the entire value chain for the lifecycle of a car. With their numerous environmental and technological advantages, EVs are accelerating the transition toward sustainable mobility. This blog post explores how EV batteries impact the value chain, from manufacturing to recycling, the UK’s regulatory framework for the environmentally responsible handling of end-of-life EV batteries, and the implications for various stakeholders.

1. Battery Manufacturing and Supply Chain

The shift towards EVs has caused changes in the manufacturing process and supply chain. Traditional automakers are investing heavily in electric vehicle production, developing new assembly lines and manufacturing facilities. Additionally, the supply chain is evolving to accommodate the production of batteries, electric drivetrains, and advanced electronics.

According to a Reuters analysis, automakers globally will invest more than half a trillion dollars in EVs through 2030. This spending will lead to increased demand for materials such as lithium, cobalt, and rare earth metals.

These investments in production capacity expansion and battery technology improvements are necessary to meet the growing demand for EV batteries.

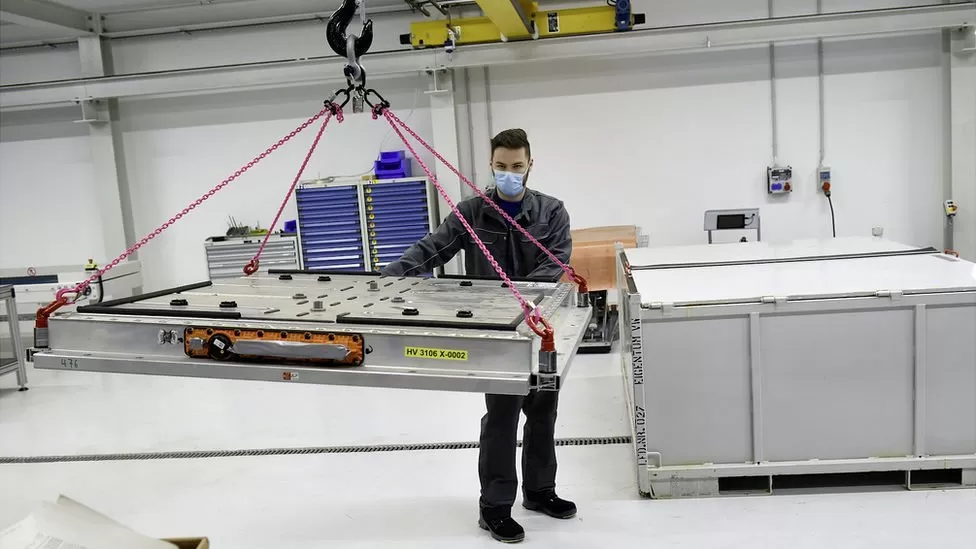

2. Battery Manufacturing

One of the key components of an EV is the battery, which has its own value chain. Battery manufacturing is becoming a crucial industry as EV adoption grows. Major players such as CATL, LG Energy Solution, and Panasonic dominate the battery manufacturing sector. These companies invest in expanding production capacity and improving battery technology to meet the growing demand for EV batteries.

One of CATL’s latest investments is a $7.48 billion battery plant in Hungary. Panasonic is also spending $5.05 billion through March 2024, with more than half earmarked for increasing its EV battery output.

3. Battery Charging Infrastructure

EV batteries need to be charged. With more car owners going electric, an investment opportunity has opened up for companies specializing in electric vehicle charging stations. These include ChargePoint, EVgo, and Tesla’s proprietary Supercharger network. These companies are expanding their operations to keep up the pace, resulting in wider public charging access. This will add more than $70 billion to the EV lifecycle value chain, according to Mckinsey.

Building a comprehensive and convenient charging network is crucial to address range anxiety and promote further EV adoption.

4. Mobility Services and Software Solutions

EVs are driving the development of new mobility services and software solutions. Companies like Uber, Lyft, and Didi are integrating EVs into their ride-hailing fleets to reduce emissions. Furthermore, software solutions for charging management, fleet optimization, and energy management are emerging to support EVs’ efficient operation and utilization.

5. Vehicle Ownership and Usage Models

The rise of EVs is also challenging traditional vehicle ownership and usage models. Car-sharing services and subscription-based models are gaining popularity, allowing users to access EVs without the commitment of ownership. This shift in consumer behaviour opens up opportunities for innovative business models and creates new revenue streams.

Mckinsey highlights that Chinese OEMs such as BYD and NIO are amplifying this change via innovative GTM strategies such as subscriptions.

6. Battery End-of-Life and Recycling

As EVs age, the recycling and disposal of batteries become paramount, making them a critical component of the car lifecycle value chain. Specialized recycling facilities are emerging to handle the growing volume of end-of-life EV batteries. Companies like Umicore and Cirba Solutions focusing on recycling and recovering valuable materials from spent EV batteries, reducing environmental impact and promoting a circular economy.

Government Regulation

Different governments have released regulatory frameworks that spell out the obligations of EV battery producers and recyclers in disposing of EV batteries. In the UK, for example, these activities fall under the remit of the Waste Electrical and Electronic Equipment (WEEE) Directive.

The WEEE is a European Union legislation created in 2002. It was updated in 2012 and incorporated into UK law in 2013 with the aim of reducing the environmental impact of waste electrical and electronic equipment.

According to the UK’s Environmental Agency, the producer is responsible for treating and recycling waste batteries in an environmentally sound manner. The producer is defined as any person or company that manufactures, imports or rebrands electrical and electronic equipment.

In the context of EV batteries, the producers include vehicle manufacturers and businesses that import EVs or components, including batteries, into the UK. This comprehensive approach ensures that all involved in the lifecycle of an EV battery contribute to its environmentally sound disposal and recycling.

However, as part of the obligations stated in the UK’s Waste Batteries and Accumulators Regulation of 2009, battery producers must register with an approved compliance scheme, which will then handle the responsibilities concerning waste battery collection and recycling on their behalf. This directive also requires producers to report the type and weight of batteries they bring into the market, along with evidence of their waste battery collection and recycling.

While the current regulations provide a robust framework for managing waste batteries, the rapid growth in the EV market presents new challenges. The high capacity, complex construction, and specific safety requirements associated with lithium-ion EV batteries necessitate a more sophisticated approach to recycling. The Global Battery Alliance is seeking to address these with its Battery Passport.

Conclusion

Electric Vehicles are transforming the value chain for the lifecycle of a car, disrupting traditional processes and creating new opportunities. From manufacturing to end-of-life recycling, various sectors are experiencing significant changes. The electrification of transportation presents exciting prospects for stakeholders, including automakers, battery manufacturers, infrastructure providers, software developers, and recyclers. By embracing these changes and collaborating across the value chain, we can accelerate the transition to a sustainable electrified future.