The transition to electric vehicles (EVs) is gaining momentum, but EV adoption is not without facing some significant challenges. The Global EV Outlook 2024 report from the International Energy Agency (IEA) highlights robust growth in EV sales globally, with electric car sales potentially reaching 17 million in 2024, accounting for over 20% of all car sales. However, this growth is not evenly distributed, with China, Europe, and the United States leading the charge, while other regions lag due to various economic and policy factors.

Contrastingly, recent commentary in the mainstream media has focused on declining residual values and slowing EV adoption rates. The Auto Trader Road to 2035 report highlights this issue by pointing out that while new EV sales have stalled somewhat, the used EV market is thriving. This dichotomy can be attributed to the increasing affordability and availability of used EVs, which are attracting a broader range of consumers.

Key Findings from the Global EV Outlook 2024

Sales Growth and Market Share

In 2023, global EV sales increased by 35%, with China, Europe, and the United States accounting for nearly 95% of these sales. The market share of EVs in these regions is expected to rise further in 2024, with projections indicating that EV sales could reach 45% in China, 25% in Europe, and over 11% in the United States. This growth is driven by competition among manufacturers, falling battery and car prices, and ongoing policy support.

Investment and Policy Support

Significant investments in EV and battery manufacturing are bolstering the industry. From 2022 to 2023, investment announcements in EV and battery manufacturing totalled nearly USD 500 billion, with about 40% already committed. Over 20 major car manufacturers, representing more than 90% of global car sales in 2023, have set electrification targets. Policies like the US Inflation Reduction Act, the EU Net Zero Industry Act and the ZEV Mandate in the UK are pivotal in driving this investment and EV adoption.

Affordability and Battery Technology

While EVs are becoming more affordable, particularly in China where over 60% of electric cars sold in 2023 were cheaper than their average combustion engine equivalents, price parity with internal combustion engine (ICE) vehicles is still a few years away in other major markets. Advances in battery technology, such as the development of lithium-iron-phosphate and sodium-ion batteries, are expected to drive further cost reductions. For instance, lithium-ion pack prices fell by nearly 14% year-on-year in 2023.

EV Adoption in the Second-Hand Market

The market for used EVs is expanding rapidly, with falling prices making them more accessible. In 2023, the market size for used electric cars was around 800,000 in China, 400,000 in the United States, and over 450,000 across France, Germany, Italy, Spain, the Netherlands, and the United Kingdom. This growth is crucial for increasing overall EV adoption, as many consumers consider used vehicles a more affordable entry point into the EV market.

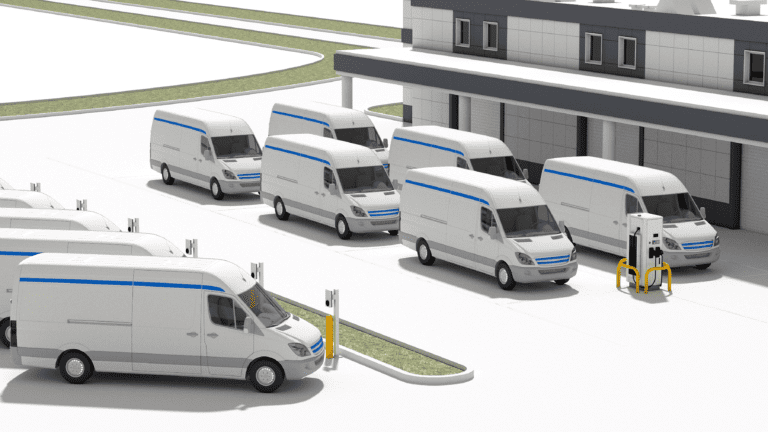

Charging Infrastructure

The deployment of public charging points increased by 40% in 2023, but more infrastructure is needed to support the projected growth in EV sales. The global number of installed public charging points needs to increase sixfold by 2035 to reach EV deployment levels in the IEA’s Announced Policies Scenario. Ensuring widespread and affordable access to charging stations is essential for mass-market adoption.

Addressing Negative Commentary

Despite the positive trends highlighted in the Global EV Outlook, there is negative commentary about EV adoption. The Auto Trader Road to 2035 report provides a nuanced view, noting that while private new EV sales have stalled, the used EV market shows strong demand where prices are right. Key points include:

Price Competitiveness

Manufacturers are increasingly offering discounts and incentives on new EVs, which is crucial for stimulating retail demand. For example, the Honda E saw a surge in demand after prices fell below a pivotal threshold. This highlights the importance of competitive pricing in driving EV adoption.

Impact of Consumer Concerns on EV Adoption

While there are still concerns about battery life and charging infrastructure, the increased availability of used EVs at competitive prices is helping to address these issues. Standardised testing for battery health and fairer charging costs are recommended to boost consumer confidence. Moreover, advances in battery technology are expected to alleviate these concerns over time.

Policy and Industry Collaboration

The report emphasises the need for continued collaboration between industry and policymakers to address affordability and battery concerns and to offer creative incentives to encourage the switch to EVs. For example, initiatives such as subsidies for EV purchases, investment in charging infrastructure, and support for domestic manufacturing are critical.

Additional Insights and Statistics

EV Adoption in Emerging Markets

In emerging markets and developing economies, EV adoption is picking up, albeit from a low base. In India, electric car registrations were up 70% year-on-year to 80,000 in 2023, accounting for around 2% of all car sales. Similarly, in Thailand, electric car registrations more than quadrupled to nearly 90,000, reaching a 10% sales share. These trends indicate a growing acceptance and demand for EVs in regions outside the traditional major markets.

Impact on Oil Demand and Emissions

The rapid uptake of EVs is expected to significantly reduce oil demand and greenhouse gas emissions. By 2030, EVs could avoid 6 million barrels per day (mb/d) of oil demand, and over 10 mb/d by 2035. This reduction is equivalent to the amount of oil used for road transport in the United States today. In terms of emissions, the transition to EVs is expected to result in substantial reductions in well-to-wheel greenhouse gas emissions.

Conclusion

The transition to EVs is well underway, with significant progress in sales and infrastructure development. However, addressing affordability and consumer concerns remains critical. By focusing on these areas, the industry can overcome current challenges and ensure a smoother transition to a sustainable and electrified future. For retailers, fleet managers, and insurers, understanding these trends and adapting strategies accordingly will be key to navigating the evolving EV landscape.

For further details, refer to the Global EV Outlook 2024 and Auto Trader Road to 2035 reports.