As the electric vehicle (EV) revolution accelerates, the automotive industry is undergoing a profound transformation. The reduced servicing requirements of EVs are at the forefront of this change, reshaping the way car retailers do business. With EVs demanding less maintenance than traditional internal combustion engine (ICE) vehicles, car retailers face both significant challenges and unique opportunities to adapt their revenue models.

How EVs are Changing the Servicing Landscape

Electric vehicles, by their very design, have fewer moving parts compared to ICE vehicles. Gone are the days of frequent oil changes, spark plug replacements, and exhaust repairs. In fact, EVs eliminate many common maintenance tasks altogether. For example:

- No oil changes: Unlike ICE cars that require oil changes every few thousand miles, EVs don’t use engine oil at all.

- Longer-lasting brakes: Regenerative braking reduces wear on brake pads, extending their lifespan significantly.

- Fewer parts to service: EVs don’t require air filters, fuel filters, or timing belts, which are common in ICE vehicles.

The Challenge for Car Retailers: A Shrinking Aftersales Revenue Pool

As a result, EVs require up to 50% less servicing over their lifetime compared to ICE vehicles. This dramatic reduction has a direct impact on the profitability of car retailers, many of whom rely heavily on aftersales services to generate revenue.

Historically, aftersales services, including routine maintenance, repairs, and parts replacements, have been a vital source of income for dealerships. A typical ICE vehicle might visit the service bay multiple times a year for tasks ranging from oil changes to brake replacements, generating consistent revenue for retailers.

However, as EV adoption increases, dealerships are facing a sharp decline in aftersales revenue. According to a study by Deloitte, the reduction in parts, maintenance, and wear-and-tear services for EVs could result in a 55% drop in aftersales profits by 2035.

This is compounded by the fact that EVs have fewer serviceable parts, meaning fewer opportunities to generate income from repairs and replacements.

For example, if a dealership previously earned €500,000 annually from servicing ICE vehicles, this figure could drop to just €250,000 or less as the EV fleet grows. The result is an urgent need for dealerships to rethink their business models and find new ways to maintain profitability.

Opportunities for Retailers in the EV Era

While the reduction in traditional servicing tasks presents a challenge, it also opens up new avenues for car retailers to capture value in the EV ecosystem. By embracing innovation and specialisation, dealerships can tap into emerging revenue streams.

1. Specialised EV Services

Though EVs require less routine maintenance, they still demand specialised services, particularly around battery health, software updates, and diagnostics. EV batteries are the most expensive component of the vehicle, and ensuring their longevity is crucial. Dealerships can offer:

- Battery health checks: Regular diagnostics to ensure optimal battery performance, which could evolve into a subscription-based service.

- Software updates: EVs rely heavily on software, offering dealerships an opportunity to provide over-the-air updates or in-shop services.

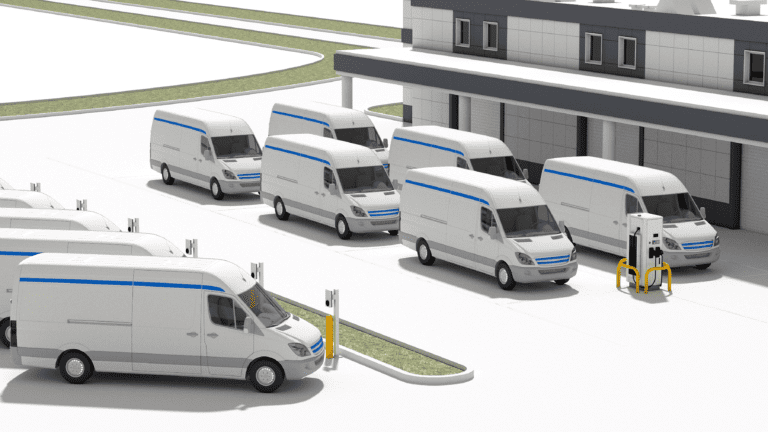

- Charging infrastructure: With the rise of home charging solutions, dealerships can offer installation and maintenance of chargers as a value-added service.

These specialised services can not only replace some of the lost revenue from traditional maintenance but also establish the dealership as a go-to provider for advanced EV needs.

2. Tyre Sales: An Overlooked Opportunity

EVs, being heavier than their ICE counterparts, exert more pressure on tyres, which can lead to faster wear and tear. Additionally, specialised low-rolling-resistance tyres designed for EVs are more expensive than standard tyres. This creates a lucrative opportunity for dealerships to focus on tyre sales.

According to Urban Science, the increased demand for EV-specific tyres could offset some of the revenue lost from traditional maintenance services. For instance, if a dealership typically sells 1,000 tyres annually for ICE vehicles at €200 per tyre, transitioning to EV tyre sales at €300 per tyre could result in €100,000 more in annual revenue.

3. Subscription and Digital Services

The shift towards EVs provides an opportunity for dealerships to offer subscription-based services. As EVs rely more on software and connected systems, dealerships can introduce subscription models for services like:

- Battery health monitoring: Providing monthly diagnostics and alerts on battery performance.

- Remote software updates: Offering regular software patches and feature upgrades as part of a service package.

For example, a subscription-based EV service priced at €10 per month for 500 EV customers would generate €60,000 annually, providing a stable and recurring revenue stream.

4. Mobile Servicing Solutions

As highlighted in the Strategy Consultants OC&C ‘The Future of the Car Dealer’ report, another promising area is mobile servicing. EVs require fewer in-shop repairs, which presents an opportunity for dealerships to offer mobile maintenance services for routine tasks such as tyre rotations, brake inspections, or even software updates. This convenience-driven model could attract a larger customer base, particularly in regions where access to EV service centres is limited.

The Role of Technological Investment

Adapting to the EV revolution will require dealerships to invest in new technologies, tools, and training. The complexity of EVs means that technicians need specialised skills to diagnose and repair electric powertrains, batteries, and advanced electronics. Dealerships that invest early in EV technician training and EV-specific equipment will be better positioned to capture the growing EV market.

For instance, investing €150,000 in technician training and equipment could yield significant returns by attracting more EV owners seeking specialised services. As the OC&C report emphasises, EV-ready dealerships will have a competitive advantage over those that are slow to adapt.

Conclusion: A Time to Adapt and Innovate

The reduced servicing requirements for EVs pose a significant challenge to car retailers who have long relied on aftersales services for profitability. However, this shift also presents an opportunity for dealerships to reinvent their business models, focusing on areas such as specialized EV services, tire sales, and digital solutions.

By embracing innovation, investing in technology, and offering tailored services for EV owners, car retailers can thrive in this new automotive landscape. The future of car retailing may look different, but for those willing to adapt, it holds immense potential.